Banking & Finance

The BFSI industry is riding on an enormous wave of entrepreneurial disruption and digital innovation. New data-driven technological advancements are challenging, established powerhouses. Banks and finance companies are caught between increasingly strict and expensive regulations and therefore the need to compete through continuous innovation.

BFSI consists of commercial banks, insurance companies, non-banking financial companies, cooperatives, pensions funds, mutual funds and other smaller financial entities. The Banking section of BFSI may also include core banking, retail, private, corporate, investment and cards. Whereas the Financial services may include stock-broking, payment gateways, mutual funds. Insurance covers both life insurance and general insurance.

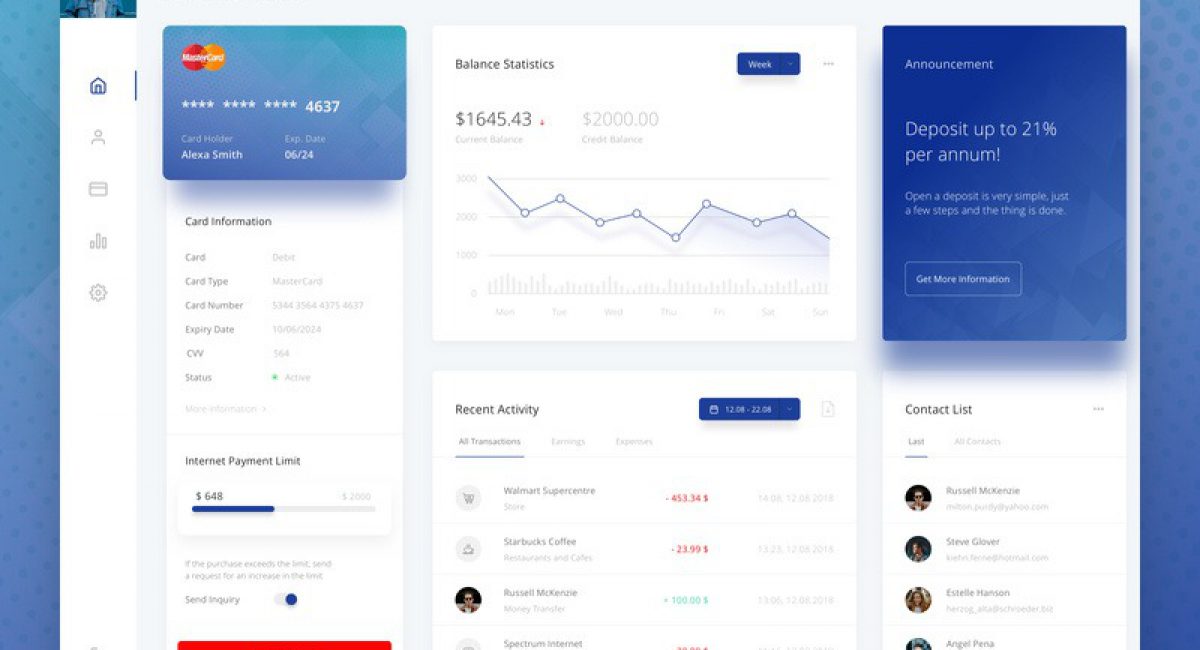

Digital transformation, at the core is about to evolve business models riding on technology disruptions, changing consumer needs and preferences, technology enabled consumer engagement models and new digital channels of product and service delivery. In today’s world digital banking priorities are linked to redefining how people interact, engage and transact, while reshaping the dynamics of the traditional banking ecosystem.

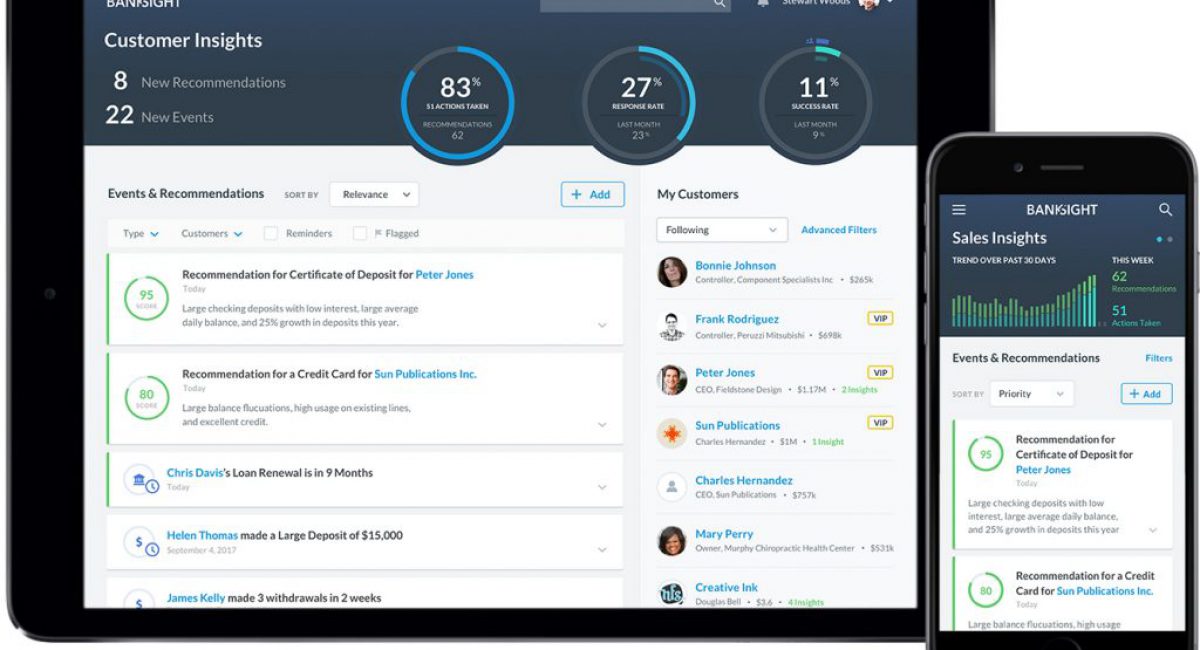

Banks and financial institutions are taking an ‘outside-in, customer centric” view to assist define and design new business priorities. In today’s world Digital banking models work with 360-degree consumer intelligence including innovative Omni channel consumer engagement that puts the “Consumer” first, every time. Financial institutions are redesigning their processes in line with new digitally enabled possibilities. As digital powered business models are disrupting the banking and financial services industry, leaders and challengers are looking at finding newer ways of sustaining competitive advantage.

Opportunities and Challenges:

• Thanks to India’s economic expansion and growing awareness among the population of the financial products and services the BFSI industry is growing significantly in these coming years.

• New and wider products can provide immense opportunities to develop niche areas

• The industry has adopted IT as an integral part of business strategy, where RSM is well positioned to supply various services on such IT platforms

• High supervision by regulators would require constant vigilance and need to adopt measures to mitigate risks based on various control measures including ‘Risk Based Audits’ (RBA) which are provided by:

o The reserve bank of India in its RBA guidelines to banks

o The Insurance regulatory authority of India (IRDA) to the insurance industry

o Securities Exchange Board of India (SEBI) for the mutual fund industry

Anvitech’s services and solutions, are designed to satisfy the growing needs of the Banking & Financial Services industry, providing leading edge insights, superior customer experience & engagement and delivering an ‘anywhere, anytime’ service delivery to consumers.

We offer solutions based on customized AI and data-driven BFSI that improve banking operations, reduce response times, and efficient management of repetitive processes. The AI-based solutions provided by us such as, chatbots handles customer service with much accuracy while our data intelligence services identifies fraudulent activities, predict future events based on past happenings, and increase customer retention.